The year is 2030. There’s no one sleeping in the streets in Portugal any more. No one has to stand queuing at the soup kitchens of the charitable associations. The beggars have disappeared. The universal basic income in the social state of the 21st century arrived in southern Europe during Covid-19. Portugal, the smallest of the five southern EU countries, decided ten years ago to provide each of its citizens with a basic income. The EU’s pilot scheme began in 2021. Prime Minister António Costa and his government, which had had a stable majority in a coalition in parliament with the PAN party since the last elections, decided to complete the revolution of 1974. The tax department now pays each of the 8,756,507 adult Portuguese citizens a basic monthly income of 600 euros for life (500 euros per month until 2025). The 1,243,493 young people under the age of 18, whose parents had hitherto received the paltry sum of 60 euros in child benefit, now receive amounts of between 150 and 250 euros per child. The new law ensures the abolition of the socially demeaning begging, and the suspicious monitoring by state social security authorities. It guarantees the state subsistence safeguard by means of an unconditional basic income without having to give anything in return.

No strong democracy is based on losers.

A piece of science fiction by Theobald Tiger.

After 2021, there were no more unemployed people or pensioners in Portugal. The country’s social security system, known as “Segurança Social”, and the employment offices (IEFP) were abolished and wound up. It was the biggest change in Portugal since the country’s reconstruction by the Marquis of Pombal after the great earthquake in 1755. The several thousand people that had previously been employed in these departments now work in the tax offices as part of a six-month retraining programme. Many of them receive extra tuition in ecology, medicine, applied mathematics, circular finance and sustainable business administration, and were prepared for the application of the new law that taxes every citizen and company at a single rate of 50% (see Milton Friedman, Nobel Prize for Economics, 1976). After the Covid-19 pandemic, a new decentralised authority, which works on the provision of expanded health services, entered into operation and guaranteed the free choice of doctor and hospital in Portugal from 2021 onwards. No one had to take a ticket to wait their turn anymore, and no one had to wait for hours or days any longer to be seen by a doctor at a hospital. The services were now paid for using state vouchers, which the health insurance companies accepted.

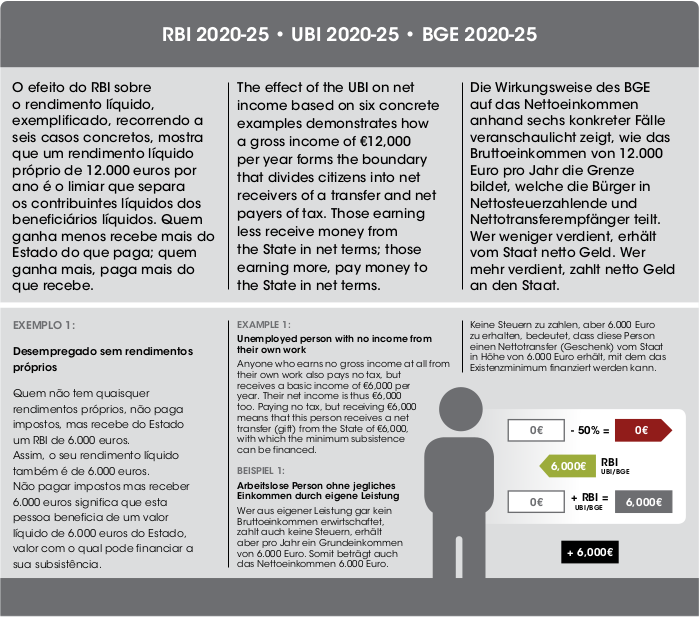

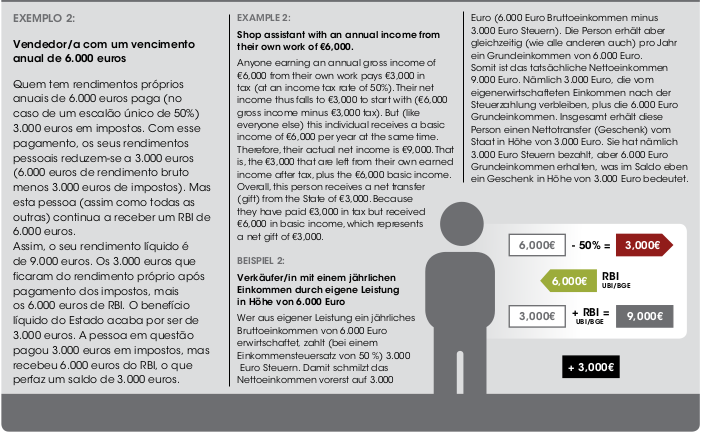

The idea that had been proposed by the Nobel prize-winner for economics has finally gained acceptance. The basic income of 600 euros per month (500 euros until 2025) is now transferred on the 30th of every month by the Ministry of Finance to the citizens’ accounts. Punctually. That makes a total per person per year of 7,200 euros (6,000 euros until 2025). When transferred to almost ten million people, the total amount comes to almost 65 billion euros per year (54 billion euros until 2025). For a year, António Costa had gathered together the best economists in Portugal in a special committee and developed a blueprint for financing the Unconditional Basic Income (UBI) in a Marshall Plan. He received backing for this from the EU Commission, the European Parliament in Brussels and the European Central Bank in Frankfurt. Under certain conditions, they were prepared to step in with up to 25 percent of the total amount per year over the last ten years of the transitional period in an emergency. But that was not necessary.

The pot that provided the money was filled with funds that were effective immediately and had been saved from the expenditure of the former “Segurança Social”. In the future, unemployment, maternity and child benefits will no longer be paid, along with many other allowances. All pension payments below the 600-euro level were compensated for with the new unconditional basic income. Those pensioners whose pensions were higher than the basic income and who received higher monthly transfers until 2021, have continued to receive the same pensions until now. However, they too were paying IRS (personal income tax), because they received the 600 euros basic protection every month before their pension. No one will have to live off pensions of less than 600 euros, and many will receive substantially more because the status of pensioner will be abolished. People who want to continue making themselves useful for a few more years will not be prevented from doing so.

For one year, economics and finance experts in the government’s specialist committee shaped the state’s new tax policy. The outcome was that, after 2021, all the former social security funds of the Ministry of Labour and Social Security were transferred to the Unconditional Basic Income budget, which then came under the jurisdiction of the Ministry of Finance:

- 13 billion euros in pension payments from the former Social Security;

- 2 billion euros in former unemployment benefits; (prestação de desemprego)

- 700 million euros in child benefits; (abono de família)

- 500 million euros in sickness benefits; (subsídio por doença)

- 450 million euros in maternity benefits (prestação de parentalidade)

- 480 million euros in poverty and pension allowances (RCI, CSI),

making a total of just over 17 billion euros.

The following amounts were transferred to the budget of the Unconditional Basic Income:

- 40 billion euros in revenue from the new IRS tax at source, which was levied on all employers, employees and public servants, and on all Portuguese and foreign companies, like Google, Amazon, Apple and Facebook, which sell products or services in Portugal (50%)*,

- 3.2 billion euros from the new CO2 eco-tax, which was levied on the combustion of oil, gas and coal by all energy producers like GALP and SU and car manufacturers like AutoEuropa, among others, service providers and consumers who discharge more than 3,000kg of CO2 per person per year into the atmosphere;

- 2.5 billion euros from the new transaction tax on all kinds of speculation in the finance and banking industry;

- 1.5 billion euros from the new industrial product tax, which is levied at source on all non-recyclable and deposit-free products;

- 1.5 billion euros from savings through lower administrative costs;

- 500 million euros in robot and automation taxes per year,

making a total of almost 49.2 billion euros.

In the first financial year of 2021, the budget for the Ministry of Finance’s Unconditional Basic Income was allocated some 66.2 billion euros. Such a clear and radical tax reform had a huge impact on salaries and the capital to labour ratio, which were analysed carefully in the first five years up to 2025 and, when necessary, adjusted. For this reason, the EU and ECB and the 26 other EU countries have been watching the Portuguese Way with great interest and have been monitoring the path towards a fair and progressive tax system, in which those who are economically strong bear a greater share of the tax burden than the weak. After the COVID-19 crisis, the situation became more stable in the following years with the introduction of the universal basic income.

Eco123 Revista da Economia e Ecologia

Eco123 Revista da Economia e Ecologia